Discover our curated list of regulated and reliable brokers available to traders from Kenya including M-Pesa deposit option.

Every broker was tested on a live account.

Top 10 Forex Brokers for traders in Kenya:

- Pepperstone – Overall The Winner in Kenya in 2024

- FBS – M-Pesa Deposits & 100% Bonuses

- Octa – Low Forex Fees

- AvaTrade – Best for Low Fees & Strong Regulation

- XM Group – $50 No Deposit Bonus & High Leverage 1:1000

- Exness – Fast Account Opening & MT4/MT5 MetaTrader

- HFM – High Leverage STP Broker

- Interactive Brokers

- IC Markets

- Moneta Markets

Overview

| Forex Broker | More Info | Benefits | Platforms | Review |

|---|---|---|---|---|

|  |

| MT4; MT5, cTrader, TradingView WebTrader, Mobile Apps | Pepperstone Review |

|  |

| MT4 MT5 FBS Trader | FBS Review |

|  |

| MT4 iOS/Android App | Avatrade Review |

|

| Webtrader MT4 / MT5 Mobile Apps | XM Review | |

|  |

| MT4 HF Copy iOS/Android App | HFM Review |

1) Pepperstone

Pepperstone is one of the best ultra low spread fx brokers in the industry.

Pepperstone is regulated in multiple top tier countries for example United Kingdom, Germany and Australia.

Pepperstone is a CMA regulated forex broker in Kenya. It is CMA licensed and therefore 100% safe and secure online broker with a robust and stable forex trading platform that comes with Metatraders, TradingView and cTrader.

Peperstone offers competitive trading costs, fast trade execution, leading customer support, and other useful features. They will also give you the opportunity to educate yourself about the trading and provide you the trading tools like economic calendar, live webinars, video tutorials, etc.

Pros:

- Capital Markets Authority authorised

- Ultra Low Spread Trading Fees starting from 0.0 Pips (Razor Account)

- Local Kenya deposit funding available

- Kenya telephone customer support line

- Offices located in Nairobi

- Minimum deposit $1

- Competitive maximum leverage

- 24/5 Customer Support

- Quality online education for traders

- MT 4 / MT 5 /cTrader + TradingView

- Scalping and hedging is allowed

Cons:

- Shilling base account currency not available yet

- No welcome bonuses

2) AvaTrade

AvaTrade is an Irish brand founded in 2006 is regulated in multiple top tier financial watchdogs like Central Bank of Ireland, FSA Japan, FSCA South Africa, ASIC Australia. AvaTrade is the best forex broker in Kenya. You can rest assured your money is safe since AvaTrade is considered safe and reliable forex broker trusted by thousands forex traders from all around the world.

When you sign up with AvaTrade you will get access to a wide range of trading platforms with access to algorithmic trading and social trading.

Pros:

- AvaTrade offers access to 1000+ financial markets not only forex

- Minimum deposit $100

- Fixed Forex Spreads (Low fees)

- Maximum leverage 1:400

- Ava Webtrader, MT4, MT5

Cons:

- Shilling base account currency not available yet

- No welcome bonuses

Our Methodology for Testing and Ranking Forex Brokers

We conducted a thorough FX market analysis and identified various brokers. Then, we opened demo accounts. Shortly after, we opened live accounts and deposited the minimum required amount into each of them. We took them for a short “test drive,” opening a long position on EUR/USD using a micro lot contract. We closed the trade regardless of whether it was in profit or loss. Next, we proceeded with the withdrawal review. None of the forex brokers were informed prior to the test. In the near future, we anticipate testing additional forex brokers licensed by the CMA Capital Markets Authority.

Expert tips for choosing the right forex broker

First of all, you need to asses your current forex trading knowledge and most importantly your trading style!

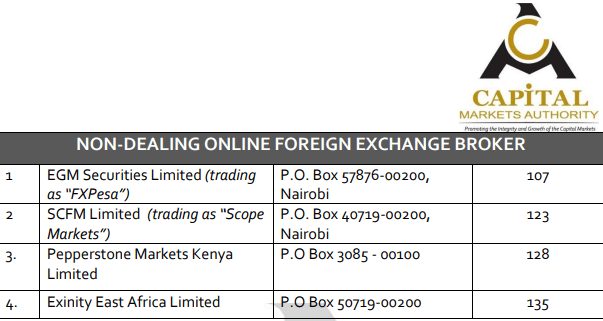

CMA Regulation

More and more middle class people start with forex trading in Kenya. Therefore the local finance market cleanup from unscrupulous companies was inevitable.

Capital Market Authority (CMA) is the state finance markets watchdog located in the capital Nairobi established in 1989 by Ministry of Finance. If anyone opens up a new local forex company, they must get the local license from CMA office. In order to obtain a CMA license a financial company must have a minimum capital of Sh50 million.

The most trusted regulatory agencies are british FCA, Cyprus CySEC and Australian ASIC. These government agencies force forex companies to implement strict security standards such as segregated accounts (where your money is safe in a first class bank account like Barclays, completely separated from the funds that broker’s own money that they use to fund the operations) some even force to offer Negative Balance Protection (meaning you will never owe more money than you deposit) to protect even those clients who are from outside of the E.U. That being said, if you open a forex trading account with forex brokerage regulated by any of these agencies, there is a high chance that your money will be safe.

High quality Australian forex broker Pepperstone has recently obtained a CMA license and operates in the country under the name Pepperstone Markets Kenya Limited . It is the broker with the strongest reputation out of all four CMA licensed brokers. With offices around the world, ultra tight spreads on currency pairs starting at 0.0 Pips,

Compare Forex Trading Fees & Commisions

Whether you are an intermediate trader or just a newbie you need to carefully inspect the fees structure, because that will make you or break you.

Remember, the lower the fees, the better!

Trading related fees:

- Spreads – The difference between SELL and BUY price in points (pips) anything over 3 Pips for the most liquid EUR/USD is usually too much and you should avoid. Spreads can be variable or fixed, it usually depends on the account type.

- Swaps – the fee you pay in order to keep the contract open over night.

- Commisions per LOT – you don’t see this very often, usually only with the top class.

Non-trading fees:

Deposit fees, Withdrawal fees, Fees for Inactivity.

Forex Trading Account Types

Depending on your budget and your own trading style, you can choose between Micro (trading Micro Lots), Mini and Standard accounts for the most serious trading activity. If you are a beginner then we recommend you to start small with Micro or Mini forex account if possible.

Minimum deposit

Some companies have very high minimum deposit requirement, which can be daunting for many traders in Kenya who are not rich. Therefore always double check the minimum investment amount with your broker first. The very minimum is around $5.

Frequently Asked Questions (FAQ’s)

Is trading forex allowed and legal in Kenya?

Yes, trading forex in Kenya is legal.

Who are the CMA-regulated brokers?

CMA-licensed brokers are: Pepperstone Markets Kenya Limited, EGM Securities (FXPesa) and SCFM Limited (Scope Markets), Exinity East Africa Limited. As the forex market in Kenya has evolved rapidly, the Kenyan financial markets regulator is expected to issue more licenses in future.

Is forex market regulated in Kenya?

Yes, Forex market in Kenya is regulated. The primary regulatory authority responsible for overseeing Forex activities in Kenya is the Capital Markets Authority (CMA).

Can I practice trading with a demo account before using real money?

Yes, you should practice trading with a demo account before using real money. Most forex brokers will allow you to use demo practice account first so that you can try their forex platform without any stress.

How can I deposit and withdraw funds with Kenyan Forex brokers?

These are the most frequent payment options that most brokers offer to Kenyan forex traders: Mobile money (MPesa, Airtel Money), e-wallets (Skrill, Neteller, Paypal), Credit and debit cards (Visa, Mastercard) and Bank Transfers.